IAG Delivers a Frictionless and Connected Customer Experience

Multinational insurance company revamps its customer engagement efforts to support its plans to be a digital-first business with Verint

-

40%

Increased customer interactions via digital channels by over 40%

-

20%

Reduced call handling times by 20%.

-

40%

Shifted over 40% of renewals to self-service

Opportunity: Create World-class Customer Experience

IAG has revamped its customer engagement efforts to support its plans to be a digital-first business. The company wanted to create world-class experiences for customers and employees and transform the way it interacts with customers in an increasingly digitally-driven and interconnected world.

With its workforce supporting 14 brands operating across five countries, IAG is Australia’s and New Zealand’s largest general insurer. The company has various policy and claims platforms, as well as multiple customer relationship management systems, making it difficult to create a cohesive and seamless customer experience irrespective of the customer’s specific brand, product, or channel of engagement.

The company is pioneering the now, next, and future state of insurance to keep pace with the phenomenal changes brought about by the digital age and industry disruption. At the forefront of this initiative are the company’s efforts to provide inspired, personalised, and frictionless customer experiences.

Deliver Highly Personalised Omnichannel Experiences

Historically, IAG handled sales, service, and claims processing predominantly through assisted channels such telephone or face-to-face via multiple complex systems. Through digital, the goal has been to flip this equation so that more business is handled via digital channels.

Alongside simplifying and reducing costs across its core technology platforms and processes, the company aspires to leverage customer insights to deliver highly personalized and relevant omnichannel experiences.

Solution: Verint Workforce Engagement

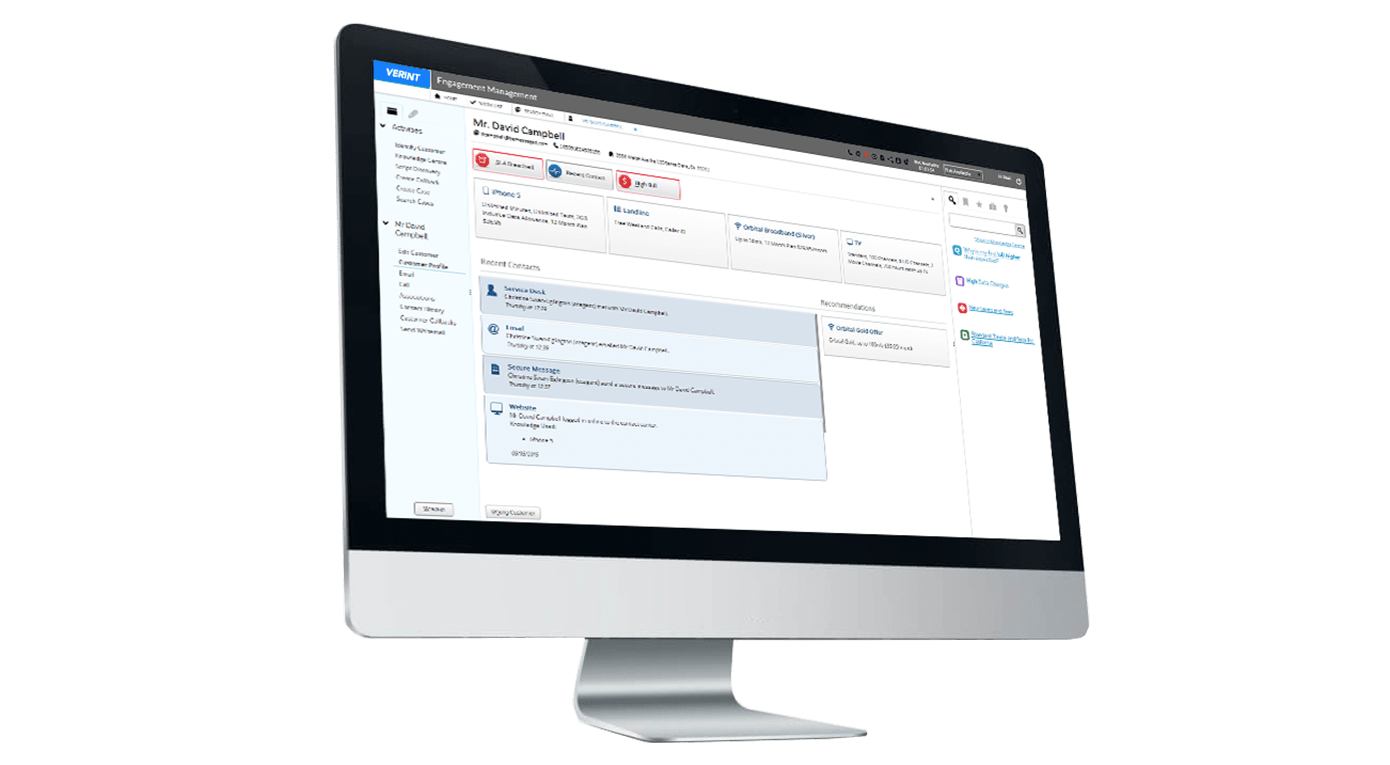

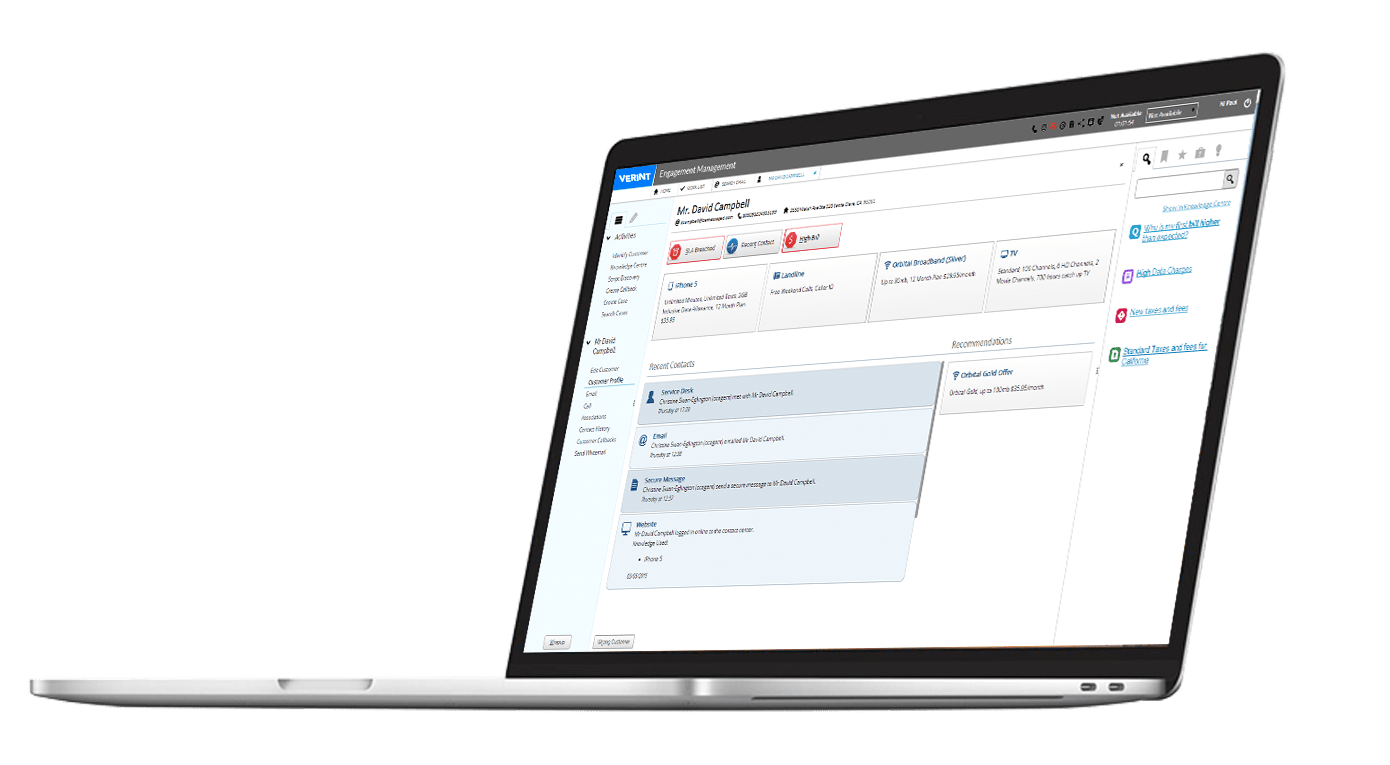

Leveraging Verint Workforce Engagement technology integrated with its systems of record, IAG developed “ORBIT.” ORBIT is a consolidated customer engagement platform supporting a frictionless and connected experience across its brands, products, and customer touchpoints, in turn helping to eliminate disjointed customer interactions and transfers.

The system provides a full view of the customer and their insurance relationships, with contextual information to simplify customer interactions and streamline customer engagement processes.

Watch Here

Optimised Agent Efficiency and Allocation

Telephony integration supports call line identification and automatic screen pop and customer identification. Web chat capability and email routing is also supported. Co-browsing allows agents to assist customers online as needed, while infused knowledge management provides relevant articles and FAQs to further help improve customer interactions.

Optimized agent allocation is achieved through skills-based routing. Agents no longer need to toggle between multiple screens and systems, as all is accomplished seamlessly in one portal.

Results: Enhanced Digital Channels for Customer Interactions

Digital once accounted for just 10 percent of all interactions with IAG customers. Digital channels now account for roughly 50 percent of all customer interactions.

“This would not have been possible without the customer engagement platform we have today,” says Nicole Shobrook, Executive Manager of digital at IAG. “Powered by Verint, the platform has enabled us to simplify and continue to digitise our business.”

IAG now supports more than 75,000 online self-service visits weekly. By enabling customers to access information and transact business online, IAG has seen a dramatic impact to its annual phone and in-branch transaction volumes.

Explore More

Reduced Call Volume and Improved Operational Efficiencies

The company has achieved an 18 percent call volume reduction. At the same time, the growth in online self-service has resulted in fewer customer visits to its branches. Collectively, this has enabled the insurer to increase efficiency in the call centres on shore and off shore whilst making the teams more effective.

Additional operational efficiencies have also helped trim call handling times. Plus, IAG’s digital-first efforts continue to deflect more and more call types to self-service. For example, with intelligent automation and digitisation supporting “smart renewals,” over 40 percent of renewals are now handled via digital channels.

“Customers interact with us through our numerous brands and many channels and distribution partners,” explains Shobrook. “When a customer comes to our business with certain needs, we must be able to access the entire group to service that need. ORBIT helps us service customer needs via automated smart triage queues across our personal insurance lines and our small business offering.”

ORBIT Helps IAG on its Simplification and Digitalisation Journey

With a full view of the customer relationship, IAG can hold rich customer conversations via intelligent messaging based on predictive analytics, which facilitates improved agent interactions in the insurer’s contact centres, branches, kiosks, and digital channels, Shobrook concludes.

“ORBIT, with all of the Verint technology under the covers, gives us a powerful tool we never had before, with enormous intelligence about our customers, products, and interactions. It is crucial to helping us execute on our simplification and digitalisation journey.”